Back

News

Sep 04, 2022

Medi-Cal Asset Limit Changes from $2,000 to $130,000: How This May Affect Your Middle-Class Clients

Sep 04, 2022

By Patricia Tobin

Assembly Bill No. 133, signed by Governor Newsom on July 27, 2021, and codified in part as section 14005.62 of the Welfare and Institutions Code, made major changes to Medi-Cal (also called the California Medical Assistance Program1), California’s version of Medicaid, which provides medical care to low-income residents. These changes also have implications for middle-class clients, especially:

- Estate planning clients who may be considering special needs trusts for their family members;

- Clients with family members who need nursing home care;

- Family law clients who are considering support for disabled children or spouses; and

- Personal injury clients who will receive a settlement and need to preserve their Medi-Cal coverage.

AB 133 also revised eligibility rules, eliminating immigration status as a consideration as of May 1, 2022, for applicants who are over age 50 and otherwise eligible for Medi-Cal. (This article will focus only on the asset limits changes. For practical information and rules concerning immigration status, see the July 22, 2021, All County Welfare Directors Letter no. 21-13(pdf).)

Understanding the Two Major Types of Medi-Cal

MAGI Medi-Cal mostly covers people aged 19 to 64 and is used by low-income families. (Other Medi-Cal programs comprehensively cover children.) MAGI Medi-Cal is the expanded Medi-Cal program Obamacare created as of Jan 1, 2014. California is one of 26 states that elected to take the essentially free federal money that allowed the expansion of Medi-Cal to cover low income, non-disabled working people.Non-MAGI Medi-Cal covers people over age 65 and disabled people of any age, and is generally the focus of attorneys who serve elderly clients, disabled children, injured plaintiffs or their family members.

MAGI Medi-Cal

For MAGI Medi-Cal, financial eligibility is determined solely by income counted under a formula that modifies the IRS Adjusted Gross Income calculation, hence MAGI for “Modified Adjusted Gross Income.” Assets are simply not considered or evaluated. Generally, in 2022, a single individual may have an annual income of up to $18,755, and a family of four may have an annual income of up to $38,295. These income limits represent approximately 138% of the Federal Poverty Level income, which is revised annually2.

If one’s income exceeds the limit, an applicant cannot qualify for MAGI Medi-Cal, but may instead qualify for a subsidized Covered California (Obamacare) private insurance plan, which would require payment of some out-of-pocket costs, such as (subsidized) co-pays, deductibles and premiums. Covered California publishes a chart each year showing income limits based on family size for different plans. 2022’s chart is reproduced below:

Non-MAGI Medi-Cal

As noted above, Non-MAGI Medi-Cal covers residents over age 65 and the disabled. AB 133 means that anyone applying for the dozens of different categories within the Non-MAGI Medi-Cal program will no longer be limited by the $2,000 asset limit that existed in California from approximately 1985 through June 30, 2022. Instead, the asset limit for single individuals will generally be $130,000. For households of two to ten persons, the limit is increased by $65,000 for each additional household member.

Understanding the General Eligibility Rules for Long-Term Care Medi-Cal

Qualifying for long-term care under Medi-Cal is a separate determination from qualifying for Medi-Cal generally. An applicant must first qualify on “Status,” which consists of looking at residency, age, disability, and citizenship or legal immigration status. As a result of AB 133, if an applicant is over age 50, the final factor—citizenship or legal immigration status—is no longer considered.If an applicant is determined to have acceptable Status, they are then evaluated to see if they qualify by having assets below the limit after several categories of assets are excluded. The definitions of these excluded categories (“exempt,” “unavailable,” and “uncounted”) remain the same as before AB 133 and include, for example, a home; IRAs “in pay status,” which Medi-Cal defines as making periodic payments of interest or principal, essentially an RMD; a car; household furnishings; and numerous other exceptions. (Cal. Code Regs., tit. 22, §§ 50425 - 50489.9.) These uncounted assets are in addition to the allowance for “countable” assets. The permissible allowance for countable assets, which are generally cash or investments, is the key change: as of July 1, 2022, a single individual may own up to $130,000. It is anticipated that as of January 1, 2024, there will be no asset limit at all for most categories of Medi-Cal. Once the applicant meets the Status rule (and Assets rule while there continues to be one), then their income will be considered. AB 133 changed only the rules regarding assets and did not affect the income rules.

Non-MAGI Income Rules

Non-MAGI Medi-Cal also has its own set of income rules, which are very complex and somewhat arbitrary. While these rules are the same as before AB 133, an extremely abbreviated overview may be helpful. These rules require recipients to pay a “Share of Cost” if their income is over a specified threshold. There are essentially four categories:

- Community Medi-Cal: the recipient pays no share of cost if their income is under $1564 per month for a single person and $2106 per month for a couple (in 2022).

- Community Medi-Cal with a high Share of Cost: if income is over the limits in paragraph 1, recipients must pay much of their income as a “Share of Cost.” Medi-Cal allows single adult recipients to keep $600 per month (referred to as “maintenance need”), couples $750, and couples over 65 $934; after you get to keep the small specified amounts, the rest of your income is subject to Share of Cost and depending upon what medical costs you have, the rest of your income may partially or entirely go to paying your Share of Cost.

- For a single person in a nursing home, all monthly “countable” income except for $35 (yes, only $35, essentially just pocket change) and certain deductions will be subject to paying your Share of Cost.

- For a married couple in a nursing home, the first $3,435 per month of income is disregarded and then the remaining monthly income is subject to Share of Cost, subject, however, to certain exceptions.

- As already alluded to, the complete income rules entail a plethora of additional complications, from the types of income counted to consideration of out-of-pocket medical costs; the foregoing summary is intended only as a broad overview and any individual’s or family’s circumstances will require a detailed analysis.

More Non-MAGI Asset Rules

Returning to asset rules for Non-MAGI recipients, AB 133 also changed the more complex rules that apply when a recipient is expected to be in a nursing home or other medical institution for 30 days or longer in order to allow the non-institutionalized or “caregiver” spouse (or Registered Domestic Partner) to keep more of the couples’ assets.

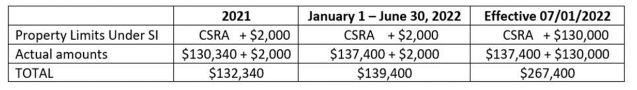

AB 133 increases the asset limit from the combined (i.e., for both spouses) 2022 limit of $139,400 to $267,4003. This level is expected to increase slightly each year. If the California Medi-Cal plan is approved by the governing federal agency (the Centers for Medicare & Medicaid Services or “CMS”), then, as of January 1, 2024, there will be no asset limit for most Non-MAGI applicants, which would be consistent with current rules for MAGI Medi-Cal (because MAGI Medi-Cal does not take assets into consideration).

AB 133 also increases the asset limits for married couples and Registered Domestic Partners in other circumstances. Once again, these asset limits are expected to be removed entirely on January 1, 2024 if CMS approves California’s Medi-Cal plan.

For couples where neither spouse or partner is in a nursing home, the first recipient keeps up to $130,000 and the second recipient can keep $65,000 for a total of $195,000, compared with the previous combined limit of $3,000. The DHCS guidelines for implementing AB 133 do not address when both spouses are in a nursing home.

Finally, where one spouse needs Medi-Cal-covered home care services under a special and limited waivered program (with wait lists and additional restrictions), the same rules as where one spouse is in a nursing home will apply, and in 2022, the spouses can keep a total of $267,400, compared with the limit before July 1, 2022, of $139,400.

Considerations for Estate Planners

- A key tool for all families, but especially for clients who may need long-term care, is an effective Durable Power of Attorney for Finances to allow access to information about finances, and to access accounts to pay for care, or to spend down or manage funds to qualify for Medi-Cal.

- One never knows who may be permanently or temporarily incapacitated, so it is important that everyone on the care team have their own affairs in order, including Durable Powers of Attorney for Finances and Health.

- For clients where a family member has assets in excess of an eligibility limit, a cost-effective choice to protect such excess funds may be to consider putting them in a pooled special needs trust or, with sufficient assets, an individual special needs trust.

- For clients of any age who were disabled prior to age 26, one could even consider funding an ABLE account to protect eligibility for Medi-Cal. ABLE accounts are similar to tax-favored 529 accounts. A disabled person can have a dedicated ABLE account, which does not count against most public benefits. “Donors,” including the disabled person, can contribute up to $16,000 annually (in 2022), and the disabled owner of the ABLE account can contribute wages of up to $12,880 (in 2022) annually to increase this reserve fund.4

- Asset transfers, if made with capacity and consent, of up to $130,000 can be made without penalty in order to meet the Medi-Cal limit. Transfers of more than $130,000 may be subject to penalties.5

Considerations for Personal Injury Recoveries

- Successful personal injury plaintiffs who have net recoveries of less than $130,000 may not need a special needs trust to preserve Medi-Cal, depending of course on existing assets, although protective financial management might still be prudent.

- While structured settlement annuity payments paid outside of a special needs trust will generally affect benefits, staggered lump sums that could be spent before the next payment in order to remain under an asset limit may now be an option, as long as the staggered amounts are sufficiently restricted until distribution so that they meet the Medi-Cal requirement for “unavailability.”

- AB 133 created less onerous Medi-Cal rules for plaintiffs who are over age 50 and lack verifiable immigration status, increasing the chances these plaintiffs may be able to preserve their recovery and Medi-Cal eligibility. But other Medi-Cal rules such as residency status and income still must be considered.

- As also noted elsewhere, the increased asset limits apply only to Medi-Cal. SSI still has a $2,000 limit, making Medi-Cal’s increased limit likely not to be of benefit to a plaintiff who needs to preserve access to the $1,040 per month income (as of 2022) from SSI.

- Once again, the increased asset limit for Medi-Cal does not apply to other public benefits, and in fact, can be a problem if the Medi-Cal recipient is receiving benefits from other programs. Furthermore, if anyone is part of a household or family that receives benefits such as Section 8, Cal-Works (i.e., child welfare benefits), food stamps, or other benefits that may be calculated based on household income and assets, holding assets which are permissible under the increased Medi-Cal asset allowance can affect the benefits of the other householders.

Considerations for Family Law Attorneys

- Disabled children who are receiving or will receive benefits from Social Security based on a parent’s work record are the key demographic who can benefit from the impending total elimination of Medi-Cal’s asset limits because they will probably not need SSI after the parent dies.

- Children in this group will also be eligible for Medicare after receiving 24 months of Social Security benefits.

- The asset limit changes place a new emphasis in divorce settlements on providing more assets and less income to the supported spouse, since periodic payments of spousal or child support may affect Medi-Cal eligibility or the extent of its services. Medi-Cal might be appropriate in a variety of situations that may not be obvious, a few of which are noted below.

- Current Medi-Cal coverage in California exceeds the services provided by Medicare. It provides more psychiatric care, more case management services, access to vision and dental care, and more social services as expanded Medi-Cal programs are put into place. While Medi-Cal services are more comprehensive, Medicare generally offers wider access to providers.

- Customary calculation of meeting the 10 years of marriage rule in order to qualify for divorced spousal Social Security benefits may benefit an aged and divorced spouse, but that spouse may still benefit from having eligibility for Medi-Cal, because a non-disabled spouse still has to wait until age 65 to get Medicare.

- But if a younger spouse is or may be disabled, timing the Social Security Disability application for benefits and the end dates of work will be important in order to meet the “currently insured” requirements to obtain Social Security Disability.6 Spouses who are certified as disabled can get Medicare after 24 months of Social Security disability payments, but during that 24-month period, and any period prior to a final approval of benefits, the spouse might benefit from access to Medi-Cal.

- In all cases, every Social Security plan must consider if either spouse is subject to the Government Pension Offset or the Windfall Elimination Provision. 7

Key Considerations for All Attorneys Working with the New Medi-Cal Asset Limits

- Medi-Cal’s increased eligibility applies only in California; if there is any chance a Medi-Cal recipient might move out of state, alternatives may be needed.

- Program rules change all the time—be prepared for possible changes.

- For Medi-Cal eligibility, don’t assume actions taken pursuant to tax or probate law will not affect eligibility. For example, an annual gift of $16,000 exempt from reporting under the lifetime estate and gift tax rules is reportable for Medi-Cal purposes and could affect the recipient's Medi-Cal benefits.

- The new asset limits are for Medi-Cal only; if a client receives other public benefits, such as SSI or Section 8 housing, increased assets may still disqualify them from benefits or affect the benefits.

- When working with a client to protect their or a family member’s public benefits, the first step is to get copies of the actual notices that describe the benefits. Don’t rely on anyone’s memory or verbal information—the names of the benefits are all so similar and there are so many different programs even under the same broad rubric (such as Section 8) that it is easy to be confused. The notices generally come in November, December, or January—and clients need to know that it is important to keep them.

- If a client’s need is coverage for someone’s in-patient long-term care (for example, for dementia), keep in mind that assisted living, with limited exceptions, will not be covered by Medi-Cal. If a patient is declining in a way where it is anticipated they will eventually need in-patient, custodial nursing home care, which is covered by Medi-Cal, in some cases it may be appropriate for the patient to reside in assisted living to “spend down” assets to become Medi-Cal eligible.

- The new asset limits are a boon for Medi-Cal eligibility but you must still consider the income and “Share of Cost” rules in planning eligibility.

- And finally, keep Estate Recovery—California’s right to reimbursement from a recipient’s probate estate for its expenses under Medi-Cal—in mind for any Medi-Cal plan.8

1 California Code of Regulations, Title 22, Social Security; Division 3, Health Care Services; Subdivision 1, California Medical Assistance Program, section 5000 et seq.

2 The rule that calculates the modified adjusted gross income (MAGI) means that those modifications to the IRS Adjusted Gross Income are applied to determine what income counts, to distinguish when income is counted as an asset and when it is counted as income, what income may be excluded and what nontaxable income may be included. A detailed analysis of calculating the MAGI is beyond the scope of this article.

3 See All County Welfare Directors Letter December 23, 2021 ACL 21-34(pdf) for this chart and further explanation:

4 More information about ABLE Accounts can be found at the ABLE National Resource Center’s website. You can also compare state plans on its website.

5 See All County Letter March 14, 2022, 22-05 (pdf) for information about transfers after July 1, 2022.

6 For information on “Currently Insured” status and disability claims, see https://secure.ssa.gov/POMS.NSF/lnx/0300301110 and https://secure.ssa.gov/apps10/poms.nsf/lnx/0300301120, and on claims for workers under age 31, see https://secure.ssa.gov/apps10/poms.nsf/lnx/0300301140.

7 SSA’s guidance on the Windfall Elimination Provision and Windfall Elimination Provision Fact Sheet (pdf); and guidance on the Government Pension Offset (pdf).

8 DHCS’ Estate Recovery rules.

Law Office of Patricia Tobin. Patricia Tobin is a Certified Specialist in Elder Law and a Certified Specialist in Estate, Trust & Probate Law.